Top Personal Finance Strategies for 2025: Build Wealth and Achieve Financial Freedom Globally

Personal finance has evolved from local budgeting to global wealth-building strategies. In 2025, financial opportunities and challenges are more interconnected than ever. Whether you’re saving for retirement, investing in global markets, or building passive income streams, understanding key trends can help you achieve long-term financial security.

1. Master Global Budgeting

Budgeting is no longer about just tracking expenses—it’s about optimizing your income across multiple streams. Digital apps like YNAB, Mint, and Goodbudget make it easier to track spending globally and save smarter.

Pro Tip: Allocate 50% of income for needs, 30% for wants, and 20% for savings/investments (50/30/20 rule).

2. Build an Emergency Fund

Financial security starts with having 3–6 months’ worth of living expenses in a separate, easily accessible account. This protects you from unexpected events like job loss or medical emergencies.

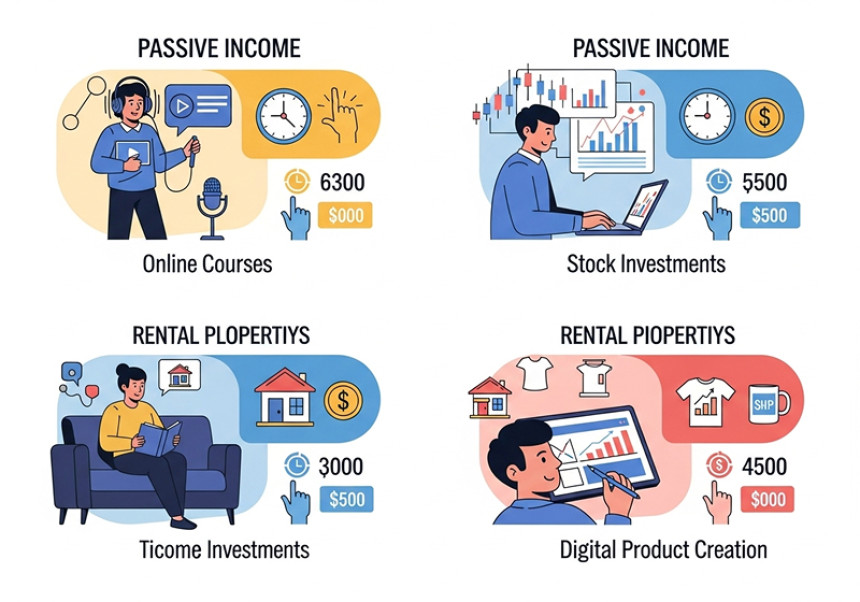

3. Explore Passive Income Opportunities

2025 offers countless ways to earn passive income:

- Digital products (eBooks, courses)

- Dividend stocks and ETFs

- Real estate crowdfunding

- Affiliate marketing and blogging

4. Invest in Global Markets

Diversify investments beyond your local market to reduce risks and maximize returns. Global ETFs, cryptocurrency, and international real estate are growing options.

5. Automate Savings and Investments

Automation ensures consistency. Set up automatic transfers to savings accounts, retirement funds, or investment portfolios.

6. Financial Literacy is Key

Stay updated on global economic trends, inflation rates, and currency movements. This knowledge will help you make informed decisions about saving, spending, and investing.

Conclusion

Personal finance in 2025 is about being globally aware, tech-savvy, and disciplined. By budgeting smartly, diversifying income, and continuously learning, you can secure financial independence regardless of where you live. For more personal finance insights, visit passiveincome.pk.